The provisions of the North Carolina Wage and Hour Act (NCWHA) set out an employer’s obligations to employee’s regarding their pay and other promised wages. The act regulates the state minimum wage, required overtime pay, payments of promised wages and other benefits, youth and employment, and required recordkeeping. Additionally, the act applies to all employers in the State of North Carolina.

If an employer violates the provisions of the NCWHA, the employee may file a civil lawsuit to recover the amounts owed to them and may be awarded punitive damages and attorneys’ fees and costs if they prevail on the claim.

What Are the Wage Requirements Under the NCWHA?

“Wages” include compensation for any labor or service, including paid time off and vacation pay, sick leave pay, severance, and bonuses or commissions that are promised to you as an employee according to company policies, practices, and employment contracts.

Under the NCWHA you are entitled to at least $7.25 per hour of work up to 40 hours of work per workweek. Once you exceed 40 hours in a workweek, you are entitled to 1.5 times your regular par for each hour worked over 40 hours. There is an exception for amusement and recreation businesses that are open seasonally. Those employees don’t receive the same overtime pay until they have exceeded 45 hours in a workweek.

Employers must pay you the wages to which you are entitled each pay period. However, a pay period can be daily, weekly, bi-weekly, semi-monthly, or monthly. The employer must notify you in writing of the policies and practices regarding paydays and pay rates at the time you are hired. Additionally, you must be notified in writing and in advance of any circumstances under which promised wages will be forfeited. In situations where you are not notified of any reasons for forfeiting your promised wages, you will still be entitled to those wages.

How Will I Be Paid Upon My Termination from Employment?

Upon termination from employment for any reason, your employer owes you for all work performed until you receive your final paycheck. When receive your final paycheck, you must be paid all regular wages due to you on or before the next regular payday. The next regular payday is the payday for the pay period in which your employment is discontinued, and does not include pay for bonuses, commissions, or other forms of promised wages.

If you request, your employer is required to mail your paycheck and cannot withhold it simply because you will not come to the business to retrieve your final paycheck. However, the employer is permitted to require a written and notarized request to receive your final paycheck via mail.

If your final paycheck is lost in the mail, your former employer has to replace the check. The costs for replacing the check, including those for placing a stop payment on the check, cannot be deducted from your paycheck absent your written authorization. However, if the final paycheck is lost after you have received it in the mail, the employer has to replace it but may deduct the costs of replacement without your authorization.

If you are owed commission or bonus pay or any other type of promised wages, you must be paid on the first regular payday after the amount becomes calculable or has been assessed.

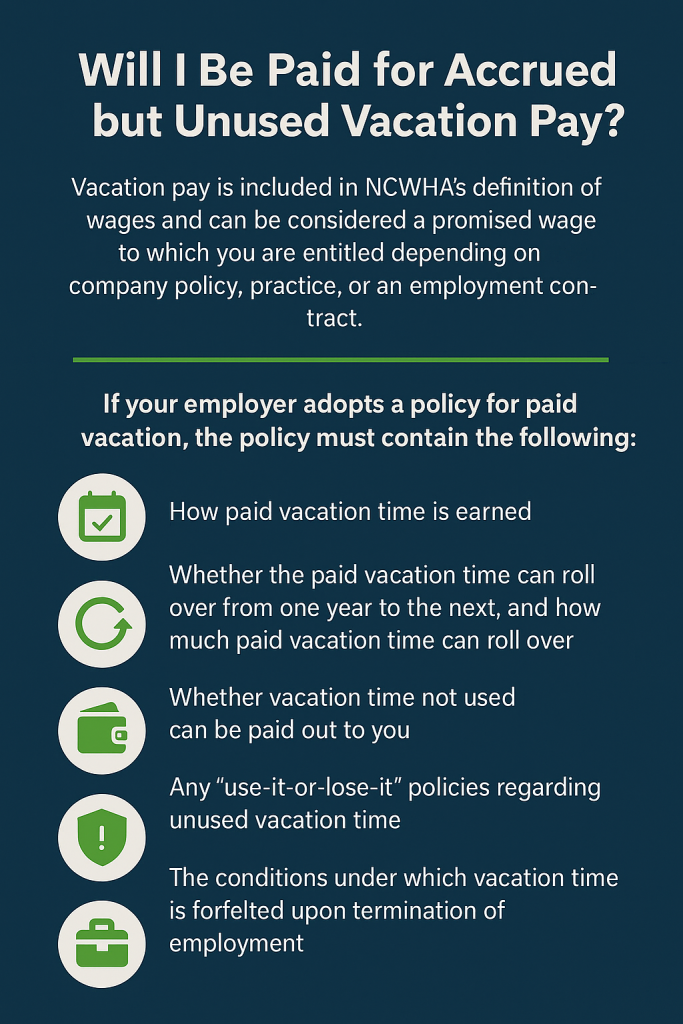

Will I Be Paid for Accrued but Unused Vacation Pay?

Vacation pay is included in NCWHA’s definition of wages and can be considered a promised wage to which you are entitled depending on company policy, practice, or an employment contract. The State of North Carolina does not require employers to provide paid time off or paid vacation time to employees. Because of this, employers have much discretion in creating leave policies that fit the needs of the business and its employees. However, where an employer’s policies and practices amount to a promise of vacation pay and other wages outside of those paid for hourly work, there may exist a legal obligation to provide such wages. Additionally, the language of a vacation pay provision in company policies or an employment contract may create a legal obligation to pay accrued vacation time that goes unused.

If your employer adopts a policy for paid vacation, the policy must contain the following:

- How paid vacation time is earned

- Whether the paid vacation time can roll over from one year to the next, and how much paid vacation time can roll over

- Whether vacation time not used can be paid out to you

- Any “use-it-or-lose-it” policies regarding unused vacation time

- The conditions under which vacation time is forfeited upon termination of employment

Any ambiguity in vacation pay policies will be generally be viewed in North Carolina courts in favor of you, the employee.

Remember that these promised wages, such as paid vacation or paid time off, cannot be forfeited absent some previous written notice from your employer stating their policies and procedures regarding wage forfeiture. Even if the policy or contract states that promised wages are forfeited upon termination of employment, there may be specific circumstances or reasons for termination under which you are still entitled to those wages.

Do You Have Questions Regarding the NCWHA or Your Employer’s Wage Policies?

Employment contracts and company policies can be complex and often use legal jargon that is difficult to understand. If you have questions about the North Carolina Wage and Hour Act or any provisions in your employment contract or company policies regarding your pay, call the North Carolina and New York employment law attorneys at The Noble Law.

Our attorneys will work to help you understand the laws regarding your hourly and promised wages and can offer you guidance on what to do in the event that your employment is terminated. We provide consultations in person at our offices in North Carolina and remotely via videoconferencing. Call the Charlotte office at 704.626.6648 or the Triangle office at 919.251.6008. You can also visit our North Carolina website to schedule a consultation.

About The Noble Law Firm

The Noble Law is a women-owned employment law firm with offices in North Carolina and South Carolina, founded by Laura Noble in 2009. Specializing in wrongful termination, workplace harassment, workplace retaliation, workplace mediation, and neutral third-party investigations, the firm is committed to leveling the playing field for employees. Their focus is on delivering positive outcomes with empathy and integrity, while also driving societal change in employment law.

The firm emphasizes diversity, collaboration, and innovation, fostering a balanced work environment that values the personal lives of its staff. With a strong commitment to technology and efficiency, The Noble Law provides personalized attention to a select group of clients, handling cases involving harassment, discrimination, retaliation, and more. The team’s extensive litigation experience allows them to deliver thorough and assertive representation.