Noble Law offers consultations and legal advice for a variety of employment law issues, including pay, overtime, and leave. Our employment law firm has offices in both South Carolina and the Triangle Region, and when you choose to partner with us, we will treat you as part of a team. Open communication is key to what we do, and our employment law attorneys will be supporting you every step of the way. When it comes to workplace disputes, it can be incredibly hard to speak out against your employer. Here at The Noble Law, our employment lawyers will work to understand your situation and help inform you of your legal options. Schedule a consultation with one of our employment law attorneys in South Carolina or North Carolina today.

Overview of Employee Rights Regarding Pay, Overtime, and Leave

At The Noble Law, we understand that work is more than just a paycheck; it is your time, your skills, and your livelihood. You deserve fair treatment for everything you contribute to your job, and that includes being paid fairly and the ability to take leave when life demands it.

That is why laws like the Fair Labor Standards Act (FLSA), the Equal Pay Act (EPA), and the Family and Medical Leave Act (FMLA) are in place. Their purpose is to make sure you are paid fairly, treated equally, and can take necessary leave for your health or your family’s without risking your job or facing retaliation. Unfortunately, some employers may disregard these laws, cutting corners or failing to fulfill their legal obligations.

If you suspect that your employer is not complying with these legal protections, the best thing you can do is seek legal counsel early in the process. We are committed to correcting any unfair treatment you have experienced and holding your employer accountable for their actions.

Statute of Limitations for Wage, Overtime, and Leave Claims

Typically, you have two to three years to file a wage, overtime, or leave claim in North and South Carolina, depending on whether the employer’s actions were willful.

One of the hardest conversations we have is when someone comes to us with a strong case, but it is too late to act. The clock starts ticking from the moment you suspect a violation, and every day counts.

The truth is, waiting only helps your employer. Contacting The Noble Law as soon as possible enables us to act quickly, preserve evidence, and file your claim within the necessary deadlines.

Common Employer Tactics to Avoid Overtime or FMLA Compliance

We have seen how employers sometimes try to skirt their obligations, using tactics that can undermine your rights. These can include employers tweaking your job title just enough to make you ineligible for overtime or casually “forgetting” hours you worked.

Here is a closer look at some common tactics that we have seen used to sidestep labor laws:

Shifting Job Titles to Avoid Overtime

Employers might change your job title or give you a minor promotion, calling you a “manager” or “supervisor,” even if your duties remain largely the same. This is an attempt to classify you as “exempt” and avoid paying overtime.

Requiring Tasks Before Clock-In or After Clock-Out

Employers might ask you to do work before or after your shift or during lunch without pay. Those hours still count and should be compensated.

Inconsistent Record-Keeping

Failing to maintain accurate time records, or intentionally logging fewer hours than you worked, is a common tactic used to underpay employees.

Delaying or Complicating FMLA Leave Requests

Employers sometimes use delay tactics for FMLA, like requiring unnecessary paperwork, giving vague instructions, or claiming they never received the documentation. This discourages employees from completing the process.

These tactics are rarely accidents—they are often calculated moves to increase profits by undercutting your rights. If your instincts tell you something is wrong, it is likely that they are right. To protect yourself, track your hours down to the minute, save every pay stub, and preserve any emails or documents related to your pay or leave; those details could make or break your case.

If you suspect an issue, contact our experienced attorneys at The Noble Law. We know what it takes to challenge unethical practices and will work with you to build the strongest possible case.

The Role of an Employment Lawyer in Pay, Overtime, and Leave Disputes

If you find yourself up against a large corporation, it is easy to feel like the odds are stacked against you. Big companies often have teams of lawyers whose job is to defend against claims like yours. But at The Noble Law, we believe no company is too big to be held accountable. We will stand beside you, working tirelessly to level the playing field.

Our process begins with a thorough consultation, where we take the time to understand the specifics of your situation. From there, we help gather all the necessary evidence and file a complaint with the appropriate agency, such as the EEOC or the Department of Labor.

If we cannot resolve the issue administratively, our team is fully prepared to represent you in court to secure the justice you deserve. While many employers prefer to settle privately to avoid the hassle of a lawsuit, we will make sure that any settlement is fair and in your best interest.

At The Noble Law, we go beyond simply filing a complaint. By hiring an employment lawyer, you are choosing an advocate who knows the ins and outs of employment law and is committed to securing a favorable outcome. Whether through negotiation or legal action, we will work hard to protect your rights and reclaim what you are owed.

Wage Theft

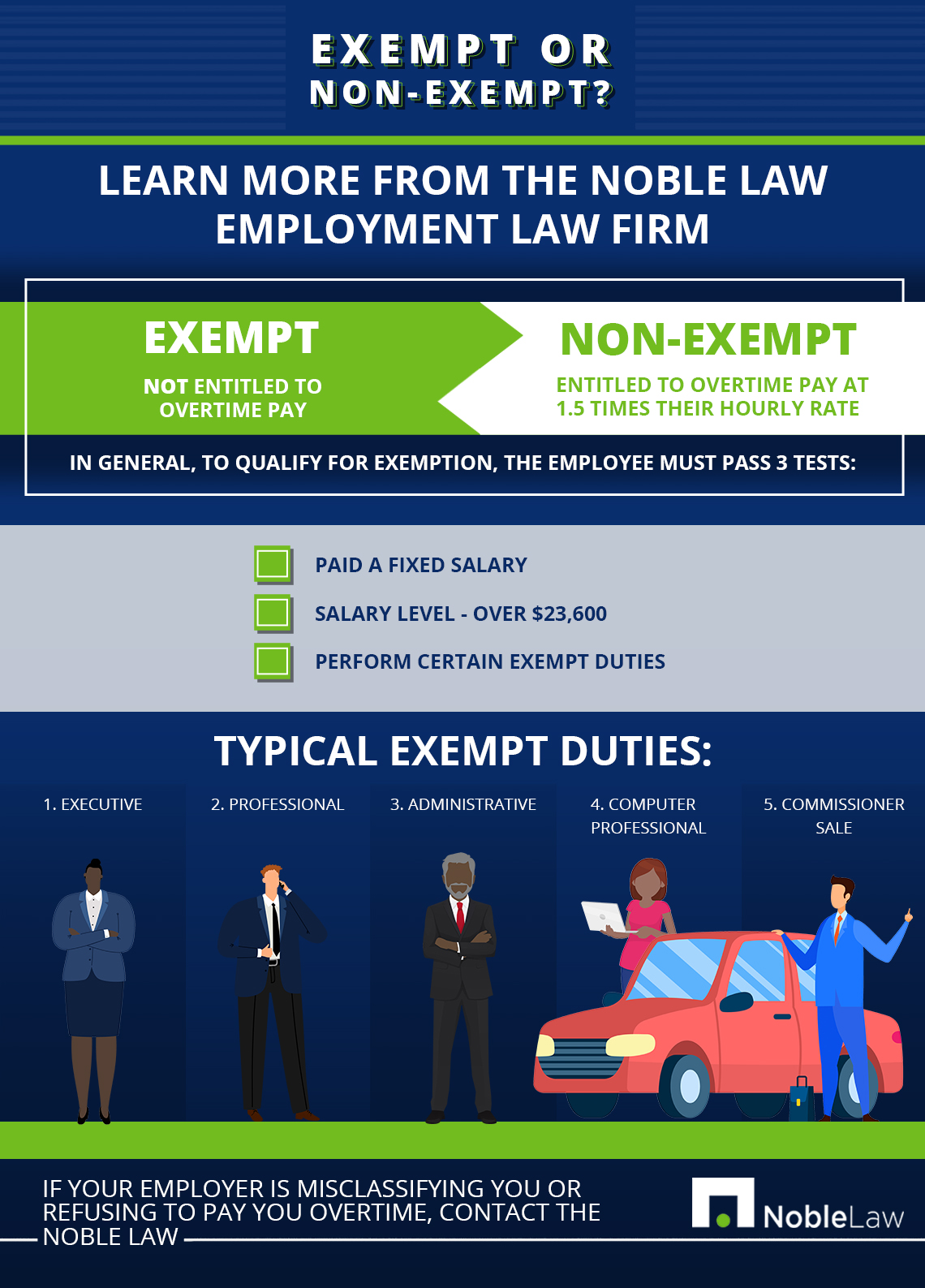

Employees are entitled to be properly compensated for every hour they work, and the Fair Labor Standards Act (FLSA) provides remedies for employees who have unpaid wages from their employers. Under the FLSA, employees are classified as either “exempt” or “non-exempt” and these classifications affect the way you are paid. If you are an exempt employee, your employer can require you to work over 40 hours in a week without providing you with overtime pay. However, if you are classified as non-exempt, your employer must pay you at an overtime rate of 1.5 times your hourly wage for every hour worked over 40 hours in a week.

If your employer is refusing to pay you overtime or is underpaying you, that is considered wage theft and you deserve to be paid in full. FLSA allows employees to receive back wages for up to two years, and the law also enforces penalties on employers who improperly classify their employees as “exempt” to avoid paying overtime pay. If you believe this is happening to you, our employment lawyers can help.

Typically, there are five categories of exempt duties — executive, professional, administrative, computer professional, and commissioner sales. Additionally, all employees who earn less than $23,600 per year are automatically classified as non-exempt. If you believe you have been misclassified, you may be entitled to retroactive overtime pay.

There are other situations where you may be a victim of wage theft, and our employment lawyers can help you understand your rights under FMLA and what your legal options are. Laws around meal and rest breaks, vacation and paid time off, and docking pay can vary from state to state. Our employment law firm has offices in both South Carolina and North Carolina, and our employment attorneys are ready to offer you legal advice and representation.

Equal Pay Act Violations

The Equal Pay Act (EPA) requires employers to provide equal pay for equal work, and if they violate this law, they may be sued for workplace discrimination. Employees have the right to work in a workplace free of compensation discrimination. These rights and protections are enforced by the Equal Employment Opportunity Commission (EEOC).

The EPA amended the Fair Labor Standards Act and applies specifically to gender-based discrimination in the workplace. Employers may not pay women and men differently who perform the same function in similar working conditions. If you are unsure of what constitutes gender-based discrimination, our employment lawyers can help.

Pay differentials are only permitted when there is some basis other than gender that justifies the pay scale. Factors other than gender can include:

- Skill – measured by factors such as experience, ability, education, and training required to do the job. These are the skills required for the job, not the skills that the employee may possess.

- Effort – the amount of mental or physical exertion needed to perform the job

- Responsibility – the degree of accountability required for the job

- Working Conditions – can include physical surroundings and hazards

- Establishment – the EPA applies only to jobs within an establishment, which is a distinct physical place of business

The burden is on the employer to prove that these differences apply to the case, not on you as the employee. Minor differences in job duties or a difference in a job title do not render work unequal, and the job does not have to be identical, just “substantially equal” in overall job content.

If you believe that your employer has violated the EPA, contact our employment law firm can help. Schedule a consultation with one of our experienced employment law attorneys at our offices in North Carolina or South Carolina today.

1099 Contractor Misclassifications

Being classified as an independent contractor instead of an employee can be very costly. You will need to pay taxes for Social Security and Medicare out of your own pocket, rather than having your employer pay half of these taxes. Independent contractors are also ineligible for unemployment benefits and workers’ compensation benefits. Independent contractors also have none of the workplace rights that employees have, such as a right to minimum wage, overtime pay, sick pay, and rest breaks. They are also ineligible for employer health care coverage.

Employers benefit from hiring independent contractors because they do not have to pay any of the taxes they are required to pay for employees. As such, they may misclassify workers as independent contractors to save money. Workers can find themselves trapped in a “gig economy” that benefits employers and deprives workers of compensation, benefits, and rights. If you believe that you have been misclassified as an independent contractor, our employment lawyers can help.

The Noble Law has successfully advocated for workers who were misclassified, and asserted claims for:

- Failure to provide employee benefits

- Failure to pay minimum wage or overtime pay

- Reimbursement of tax money paid by misclassified workers

- Injunctive relief to obtain proper classification from employer

Our employment law firm has offices in both South Carolina and North Carolina, and our employment lawyers have a deep understanding of employment law in both states. We help contractors understand their legal options and choose the best litigation strategy to meet their needs. Contact us today to schedule a consultation.

Family And Medical Leave Act Violations

The Family And Medical Leave Act is a labor law that requires employers to provide employees with unpaid, job-protected leave for specified family and medical reasons. When an employee takes FMLA leave, the employer must continue group health insurance coverage, under the same terms and conditions as if the employee had not taken leave. Employees are entitled to up to 12 workweeks of unpaid leave per year. You are eligible for FMLA leave for any of the following conditions:

- Birth of a child or placement of a foster child or adopted child

- Caring for an immediate family member with a serious health condition

- The employee’s own serious health condition

- A “qualifying exigency” related to a family member in the military

To be eligible to take leave under FMLA, an employee must work for a covered employer, have worked 1,250 hours during the 12 months prior to starting leave, work at a location where the employer has 50 or more employees and worked for the employer for 12 months.

FMLA law protects employees and helps them to balance their work, health, and family responsibilities. However, not all employers understand the law, and some willfully deny employees coverage. For example, an employer may fail to recognize serious health conditions or may discipline an employee for their FMLA-qualified absences. They may also fail to continue health insurance or pressure employees who are on leave to return to work sooner than the employee wants. An employee may even be fired for taking FMLA leave.

Illegal and unethical workplace behaviors, like FMLA violations, marginalize employees. If you believe this has happened to you, contact an employment attorney at The Noble Law. You may be able to be reinstated to your position or be paid the wages and benefits lost because of an FMLA violation. Our employment law firm has offices in both North Carolina and South Carolina. Schedule a consultation with an employment attorney today.

Learn More

Part of our mission here at The Noble Law is educating our communities in North Carolina and South Carolina about employment law and workers’ rights. Part of our job as employment attorneys is to share our expertise with others, and we do so through educational employment law videos and our Noble Notes blog. If you’re interested in learning more about employment law regarding pay, overtime, and leave, or other issues in employment law, explore our resources below:

Along with representing clients with claims in the area of pay, overtime, and leave, we also represent employees in a variety of other areas of employment law. These include:

- Executive compensation disputes

- Workplace discrimination

- Retaliation and whistleblower law

- Workplace harassment, sexual harassment, and workplace assault

- Workplace investigations

Along with representing clients with claims of workplace harassment, sexual harassment, and workplace assault, we also represent workers in other areas of employment law. These areas include executive compensation disputes, workplace discrimination, retaliation and whistleblower protections, and pay, overtime, and leave. Learn more about our employment law firm’s Practice Areas and check out our About Page, and if you’re interested in speaking with one of our employment attorneys in North Carolina or South Carolina, contact us today.